Gone are the days when you would have to wait for days to see whether the cash you transferred had arrived at its destination or not. With the most recent headways in banking and in advanced installments and transfers, the errand of sending cash has been made somewhat moment, with real-time transfers.

Nowadays, there are various approaches to transfer cash to anyplace on the planet. These online transfers chiefly incorporate NEFT, IMPS, and RTGS transfers.

To Understand the what is the Difference Between NEFT and RTGS First, We Have To Understand what is NEFT ( National Electronic Funds Transfer ) and What is RTGS Real-time gross settlement

Table of Contents

The Full Form of NEFT & RTGS is Given Below

- National Electronic Funds Transfer

- Real-time gross settlement

What is NEFT ( National Electronic Funds Transfer )

NEFT (National Electronic Funds Transfer) is a system for the electronic transfer of funds between banks in India. It allows customers to transfer money from one bank account to another bank account, either within the same bank or a different bank, using a network of electronic funds transfer systems. Transactions are processed in batches, with settlements taking place at regular intervals throughout the day.

The primary function of the National Electronic Funds Transfer (NEFT) system is to facilitate the transfer of funds electronically between banks in India. This allows individuals and businesses to easily and quickly transfer money from one bank account to another, either within the same bank or a different bank.

Some of the key functions of NEFT include:

- Enabling customers to initiate fund transfer transactions through their bank’s online or mobile banking platform, or by visiting a bank branch

- Allowing customers to transfer funds to any bank account in India

- Processing transactions in batches at regular intervals throughout the day

- Providing real-time confirmation of successful transactions to customers

- Providing a secure and reliable system for fund transfers

- Facilitating banking transactions for micro, small and medium enterprises and other customers.

Understanding NEFT

The following points will help you understand what is NEFT as a money transfer mode-

- NEFT is a one-to-one payment facility

- NEFT transactions can be processed only between the banks that offer NEFT-enabled services

- Transactions made through NEFT do not take place in real-time; implying that it takes a few days for NEFT transactions to complete

- Before December 2019, RBI had fixed timings during which NEFT transactions can be processed. Any NEFT transaction will be processed only between 8:00 AM and 6:30 PM from Monday to Friday, and 8:00 AM to 12:00 PM on Saturdays. However, from 2020, NEFT transactions can be performed 24*7

- To transfer funds through NEFT, you must add beneficiaries on the internet banking portal of your required bank

- There are no limits on the amount of NEFT transactions

- There is a fee applicable on all NEFT transactions; the amount varies from Rs. 2.5 to Rs. 25, depending on the amount being transferred

- As per RBI guidelines, the payments made via NEFT are processed and settled in batches of half-hour

Steps for an NEFT Money transfer

There are several steps involved in making a National Electronic Funds Transfer (NEFT) in India:

- Log in to your bank’s online or mobile banking platform, or visit a bank branch to initiate a fund transfer.

- Select the NEFT option from the list of available fund transfer options.

- Provide the necessary details of the beneficiary, such as their name, account number, and the Indian Financial System Code (IFSC) of their bank branch.

- Enter the amount you wish to transfer and select the account from which the funds will be debited.

- Review the details of the transaction to ensure that they are correct.

- Enter a transaction reference number or a narration for the transaction.

- Confirm the transaction by entering your login credentials, such as a password or a one-time PIN.

- You will receive a confirmation of the transaction, either through an SMS or email, depending on the bank.

Note: The above steps are general steps, it may vary depending on the bank’s online portal or mobile app.

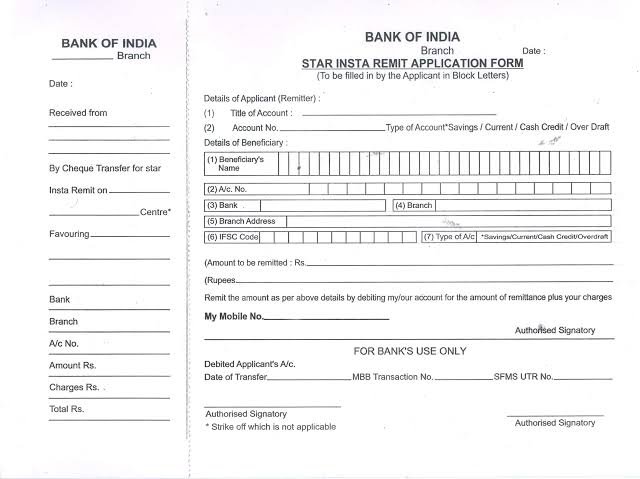

Image of NEFT form

What is RTGS ( Real-time gross settlement )

RTGS stands for Real Time Gross Settlement. It is a system for electronic transfer of funds in which the transfer of money takes place from one bank to another on a real-time and gross basis. This means that the transfer of funds is done on a one-to-one basis and not in batches, as is the case with the National Electronic Funds Transfer (NEFT) system. The funds are transferred in real-time, which means the beneficiary account is credited immediately. It is mainly used for high-value transactions and is considered to be a safe and secure way to transfer funds. Only banks are eligible to use RTGS system. It is also used for settlement of interbank transactions.

Key Function of RTGS

The main function of the Real Time Gross Settlement (RTGS) system is to facilitate the real-time transfer of funds between banks in India. It is used primarily for high-value transactions, such as large business payments or government transactions. Some key functions of the RTGS system include:

- Allowing for real-time transfer of funds between banks, with immediate credit to the beneficiary account.

- Providing a secure and reliable system for fund transfers

- Facilitating the settlement of interbank transactions

- Providing real-time confirmation of successful transactions to customers

- Allowing for the transfer of large sums of money

- Facilitating banking transactions for large businesses, government agencies, and other organizations that have a high volume of transactions.

RTGS transactions have higher value limit compared to NEFT. The minimum amount limit for RTGS is 2 Lakh and there is no upper limit for RTGS transactions. Because of the real-time processing, it is considered more safe and secure compared to NEFT.

Here’s how RTGS transactions work-

The RTGS administration window for client’s transactions is accessible to banks from 9:00 am to 4:30 pm on weekdays and from 9:00 am to 2:00 pm on Saturdays for settlement at the RBI-end. Notwithstanding, the timings that the banks pursue may differ contingent upon the client timings of the bank branches, the national bank noted.

The base adds up to be remitted through RTGS is Rs 2 lakh. There is no upper roof for RTGS transactions.

The steps to make a Real Time Gross Settlement (RTGS) transfer in India are similar to those for a National Electronic Funds Transfer (NEFT) transfer, but with a few additional steps. The general steps are:

- Log in to your bank’s online or mobile banking platform, or visit a bank branch to initiate a fund transfer.

- Select the RTGS option from the list of available fund transfer options.

- Provide the necessary details of the beneficiary, such as their name, account number, and the Indian Financial System Code (IFSC) of their bank branch.

- Enter the amount you wish to transfer and select the account from which the funds will be debited.

- Review the details of the transaction to ensure that they are correct.

- Enter a transaction reference number or a narration for the transaction.

- Confirm the transaction by entering your login credentials, such as a password or a one-time PIN.

- Provide the additional details like the purpose of transaction, the remitter’s PAN number and the remitter’s mobile number.

- You will receive a confirmation of the transaction, either through an SMS or email, depending on the bank.

Note that the above steps may vary depending on the bank’s online portal or mobile app.

It’s also worth noting that there are specific time window for RTGS transaction, the transactions can be done during the working hours of the RTGS system, which is from 7:00 am to 6:00 pm on weekdays and from 7:00 am to 2:00 pm on Saturdays.

Steps for an RTGS Fund transfer

Step 1: Go to the Fund Transfer tab, and select ‘Transfer to other banks’ (RTGS)

Step 2: Select the recipient account and enter the relevant details

Step 3: Accept the (Terms and Conditions)

Step 4: Recheck the details, if all are correct, then confirm and complete the process

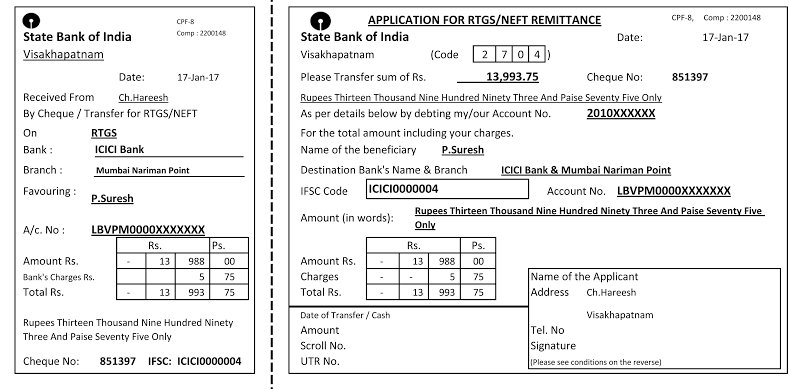

Image of RTGS form

DIFFERENCES BETWEEN NEFT & RTGS in Tabular Format

Here is a comparison of the key differences between the National Electronic Funds Transfer (NEFT) and Real Time Gross Settlement (RTGS) systems in India:

| NEFT | RTGS |

|---|---|

| Fund transfer in batches | Fund transfer in real-time |

| Minimum transaction limit is Rs.1 | Minimum transaction limit is Rs. 2 Lakh |

| No upper limit for transaction | No upper limit for transaction |

| Timings: 8 am to 7 pm on weekdays and 8 am to 1 pm on Saturdays | Timings: 7 am to 6 pm on weekdays and 7 am to 2 pm on Saturdays |

| Used for small value transactions | Used for high-value transactions |

| Funds are settled in hourly batches | Funds are settled in real-time |

In summary, NEFT is mainly used for small value transactions and the transactions are settled in hourly batches. On the other hand, RTGS is mainly used for high-value transactions and funds are settled in real-time. Also, RTGS transactions have higher value limit compared to NEFT.

Difference Between NEFT and RTGS: FAQs

Q.What are the most common methods of online money transfer?

Ans: The various methods of online money transfer include RTGS, IMPS, NEFT, UPI and digital wallet. Each of these methods can be performed online and allow easy and fast money transfer facility

Q.Is money transfer free of cost?

Ans: In most domestic transactions, money transfer is free of cost. However, some banks may charge a minimal fee on money transfer through a specific method