Table of Contents

Recent Trends in Indian Money Market

Hello Dear Aspirants,

Recent Trends in the Indian Money Market in Details: include a shift towards digital transactions and online platforms, as well as increased government regulations and oversight. The Reserve Bank of India (RBI) has implemented measures to promote financial inclusion and accessibility, such as the introduction of new digital payment systems and mobile banking options. The government has also introduced several policies to encourage investment in the money market, such as tax incentives for certain types of investments and lower interest rates on loans. The Indian economy has been hit hard by the Covid-19 pandemic and it has also affected the money market. The government has also announced a series of measures to boost the economy, such as lowering interest rates, increasing liquidity, and providing fiscal stimulus. These measures are expected to help stabilize the money market and promote economic growth in the coming months.

What Is the Money Market?

The money market is a segment of the financial market in which financial instruments with high liquidity and short maturities are traded. The money market is used by participants as a means for borrowing and lending in the short term, with maturities that usually range from overnight to just under a year.

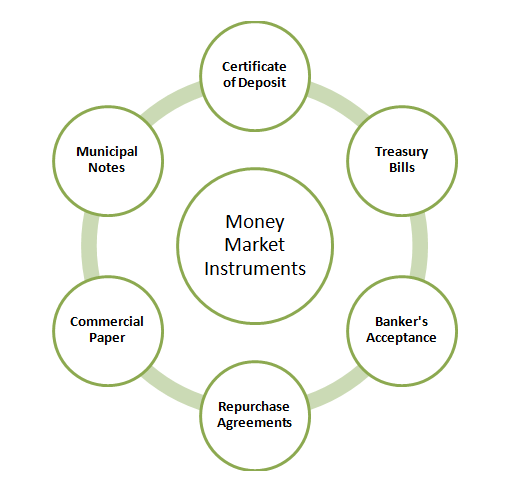

Examples of money market instruments include Treasury bills, commercial paper, certificates of deposit, and bankers’ acceptances. These instruments are issued by governments, financial institutions, and corporations and are typically considered to be low-risk investments.

The money market is important because it provides companies and governments with a means of raising short-term capital, and it also allows individuals and institutions to invest cash for a short period with a relatively low level of risk. The money market also plays a key role in the overall functioning of the economy by facilitating the flow of funds between savers and borrowers.

In all of these cases, the money market is characterized by a high degree of safety and relatively low rates of return.

Recent Trends in Indian Money Market in Details

KEY TAKEAWAYS

- The money market involves the purchase and sale of large volumes of very short-term debt products, such as overnight reserves or commercial paper.

- An individual may invest in the money market by purchasing a money market mutual fund, buying a Treasury bill, or opening a money market account at a bank.

- Money market investments are characterized by safety and liquidity, with money market fund shares targeted at $1.

Features of the Indian Money Market:

The RBI is very affected by the working of the Indian Money Market. Along these lines, proficiency of the Money Market is extremely important.

The money market plays several important roles in the Economy:

- Facilitating the flow of funds: The money market provides a platform for the borrowing and lending of short-term funds between various participants, including governments, financial institutions, and corporations. This helps to ensure that there is a steady flow of funds available for various economic activities.

- Providing short-term investment opportunities: The money market offers investors a way to earn a return on their cash holdings while keeping the investment low-risk. This is important for individuals and institutions who have short-term liquidity needs.

- Managing liquidity: The money market helps to manage the overall liquidity in the economy by providing a way for financial institutions to borrow and lend funds on a short-term basis. This helps to ensure that there is enough cash available to meet the needs of the economy.

- Setting Interest Rates: The money market helps to determine the level of interest rates in the economy. The rate at which money market instruments are traded reflects the overall level of demand for funds and the level of risk associated with lending funds. This rate, in turn, serves as a benchmark for other interest rates in the economy.

- Reducing Risk: The money market helps to reduce the risk of economic downturn by providing a stable source of short-term funding for companies, banks and other financial institution.

Also Check:

Features of the Indian Money Market:

1. Parts of the Money Market:

The Indian market is portrayed by the nearness of different sorts of budgetary foundations, for example, Non-Banking Financial Intermediaries, Cooperative Banks, Export-Import banks, indigenous loan specialists et cetera. They oblige the money-related requirements of various parts.

2. Indigenous Markets:

Money Market is about indigenous segments like indigenous loan specialists et cetera. Numerous Non-Banking Financial Companies (NBFCs) have come up, which raise assets from the overall population. NBFCs are outside the control and supervision of the RBI.

3. Rates of Interest:

Indian Money Market is portrayed by decent variety in loan fees. Prime illustrations are the Government acquiring rates, store and loaning rates of business banks, store and loaning rates of co-agent banks et cetera. This assorted variety is a result of the fixed status of assets from one area of the currency market to another.

4. Unpredictable Call Money Market:

Indian Call Money Market rate is very unstable. In crest season it might shoot up to 7-8%. Be that as it may, in the slack season it tumbles to as low as 0.5%. RBI attempts to direct this instability in the Call Money Market by providing extra subsidies when supply is short and when call rates are high. Likewise, it ingests the extra subsidies when Call Money Market has surplus assets. Sadly, despite every one of the endeavors made by RBI, the changes in the Call Money Market rates keep on being high.

5. Composed and Unorganized Sectors:

The Indian Money Market has two divisions, Organized Sector, and Unorganized Sector. The collaboration and contact between the areas aren’t excessively incredible. Likewise, the rate of enthusiasm for both the business sectors varies broadly.

6. Occupied and Slack Seasons:

Owing to fluctuating interest for assets, there are two seasons in the Indian currency Market, to be specific, the bustling season and the slack season. November to April is the bustling season as agrarian items come into the market during this time. Along these lines, the interest for assets during this period is high. May to October is the slack season. During this time, reserves are compensated and interest for reserves falls.

7. The strength of Government Securities:

Indian Money Market is overwhelmed by Government Securities and Semi-Government Securities.

8. Immature Bill Market:

Indian Money Market has an immature Bill Market. Because of this, it has no Acceptance and Discount Houses.

9. Remote Money Markets:

There is no development of assets between the Indian Money Market and Foreign Money Markets. Be Wise, Get Rich.

Indian currency advertisement is separated into two segments:

1) Unorganized cash market :

The unorganized cash market refers to the informal and unregulated market for cash transactions, typically involving small amounts of money. This market operates outside of the formal banking system and is not subject to government regulations and oversight.

Examples of unorganized cash market include street vendors, hawkers, small shops and other small businesses that mainly deal in cash transactions. The transactions in this market are mainly conducted in cash, and there is no formal record keeping or documentation.

This market is often characterized by high interest rates, lack of transparency, and a higher risk of fraud. It can also be difficult for individuals and small businesses to access credit from traditional financial institutions, leading them to turn to the unorganized cash market for loans.

The Reserve Bank of India has made several efforts to formalize the unorganized cash market by promoting financial inclusion and digital payments. However, it still remains a significant portion of the economy and can present various challenges for the government and financial institutions.

2) Organized cash market :

The composed currency advertisement is that part that goes under the administrative ambit of RBI and SEBI. Governments (Central and State), Discount and Finance House of India (DFHI), Mutual Funds, Corporate, Commercial, or Cooperative Banks, Public Sector Undertakings, Insurance Companies, Financial Institutions, and Non-Banking Financial Companies (NBFCs) are the key players of Organized Indian Money Market. The structure of the composing currency market of IndiaThe sorted-out currency showcase in India is anything but a solitary market. It is a blend of business sectors of different instruments.

- Call cash or notice money all cash, see cash, and term currency markets are sub-markets of the Indian currency showcase. These business sectors give assets to the here and now. Loaning and obtaining from the call currency advertise for 1 day. Whereas loaning and acquiring assets from seeing currency showcase is for 2 to 14 days. Furthermore, when there is obtaining and loaning of assets for the tenor of over 14 days, it alludes to “Term Money”.

- Treasury billsThe Bill advertising is a sub-market of this market in India. There are two sorts of bills in the currency showcase. They are treasury bills and business charges. The treasury bills are otherwise called T-Bills, T-bills are issued by the Central bet for the benefit of the Government, through Commercial Bills are issued by Financial Institutions. Treasury bills don’t yield any premium, yet it is issued at rebate and reimbursed at the standard at the season of development. In T-charges there is no danger of default; it is a protected speculation instrument.

- The business billsCommercial charge is a currency advertisement instrument which is like the bill of trade; it is issued by a Commercial association to fund-raise for here-and-now needs. In India, the members of the business charge advertising are banks and money-related institutions.

- Authentication of deposit certificate of Deposits otherwise called CDs. It is a debatable currency advertisement instrument. It resembles a promissory note. Rates, terms, and sums change from establishment to organization. Compact discs guessed exchanged publically neither one of them is exchanged on any exchange. In general foundations issue testament of the store at rebate all over-esteem. The banks and money-related establishments can issue CDs on a gliding rate basis.

- Business papers business paper is another currency advertisement instrument in India. We additionally call business paper CP. CP alludes to a fleeting unbound currency advertise instrument. Enormous companies with great FICO assessments issue business papers as promissory notes. There is no security bolster for CPs. Subsequently, just vast firms with impressive budgetary quality can issue the instrument.

- Currency advertises shared assets (MMMFs)Money Market Mutual Funds were presented by RBI in 1992 and since 2000 they are brought under the control of SEBI. It is an open-finished common reserve that puts resources into here-and-now obligation securities. This sort of shared store is a shared store that exclusively puts resources into instruments of this market.

- Repo and turn around repo market repo signifies “Repurchase Agreement”. It exists in India since December 1992. REPO implies pitching security under consent to repurchase it at a foreordained date and rate. The individuals who bargain in government securities utilize repo as medium-term borrowings.

Functions of the Indian Money Market:

- Currency markets are a standout amongst the most critical instruments of any creating money-related framework. In its place of simply guaranteeing that the currency advertises in India manages the stream of credit and credit rates, this instrument has risen as one of the huge strategy devices with the administration and the RBI to control the budgetary arrangement, cash supply, credit creation, and control, swelling rate and by and large monetary approach of the State. Along these lines, the first and the main capacity of the currency advertise component are administrative in nature. While deciding the aggregate volume of credit plan for the six-month to month time spans, the credit approach additionally goes for coordinating the stream of credit according to the needs settled by the legislature as indicated by the prerequisites of the economy. Acknowledge strategy as an instrument is critical to guarantee the accessibility of the credit in adequate volumes; it likewise takes into account the credit needs of different divisions of the economy. The RBI helps the administration to understand its approaches identified with the credit designs all through its statutory power over the saving money arrangement of the nation.

- The budgetary approach then again has a longer-term viewpoint and goes for amending the irregular characteristics in the economy. Credit strategy and the money-related arrangement both adjust each other to accomplish the long-haul objectives solid disapproved by the legislature. It does not just keep up add up to power over the credit creation by the banks, yet additionally keeps a nearby watch over it. The instruments of money-related strategy tallying the repo rate money save proportion and bank rate are utilized by the Central Bank of the nation to give the important heading to the financial approach.

- Swelling is one of the serious monetary issues that all the creating economies need to confront occasionally. Patterned changes do impact the value level contrastingly relying on the request and supply circumstance at the given purpose of time. Currency advertises rates assume a fundamental part in controlling the value line. Higher rates in the currency markets diminish the liquidity in the economy and have the impact of decreasing the monetary action in the framework. Lessened rates then again increment the liquidity in the market and cut down the cost of capital extensively, in this manner raising the speculation. This capacity additionally helps the RBI to control the general cash supply in the economy.

Recent Trends in Indian Money Market in Details (FAQ)

Q. What is the money market explained?

Ans: The money market is defined as dealing in debt of less than one year. It is primarily used by governments and corporations to keep their cash flow steady, and for investors to make a modest profit. The capital market is dedicated to the sale and purchase of long-term debt and equity instruments

Q. What is the money market called?

Ans: Money market trades in short-term financial instruments commonly called “paper”. This contrasts with the capital market for longer-term funding, which is supplied by bonds and equity

Q. What are the 4 types of money?

Ans: The 4 different types of money as classified by the economists are commercial money, fiduciary money, fiat money, and commodity money.

Q. How can I trade the money market?

Ans: The money market and its instruments are usually traded over the counter, and therefore, cannot be done by standalone individual investors themselves. It has to be done through certified brokers, or a money market mutual fund.

Q. What is the nature of the money market?

Ans: The money market is an organized exchange market where participants can lend and borrow short-term, high-quality debt securities with average maturities of one year or less. It enables governments, banks, and other large institutions to sell short-term securities.

Q. What affects the money market?

Ans: The money market determines the interest rate. The demand for money in the money market is affected by income (which is determined in the goods market). B. The goods market determines income, which depends on planned investment.

Q. Which currency is strongest in the world?

Ans: Kuwaiti dinar

We hope you Like this Post If any other important information related to Recent Trends in Indian Money Market has been missed in this article, then you must tell in the comment box so that more friends can be helped. Thanks